INDICATORS - Performance

Financial and non‑financial performance

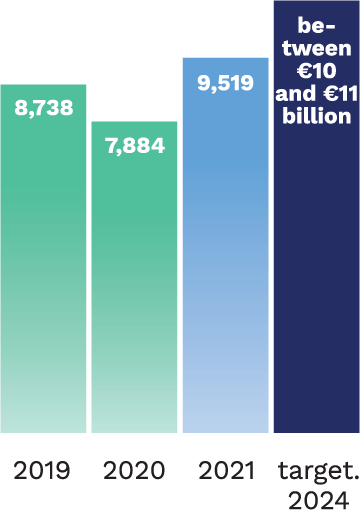

Exceptional financial results in 2021

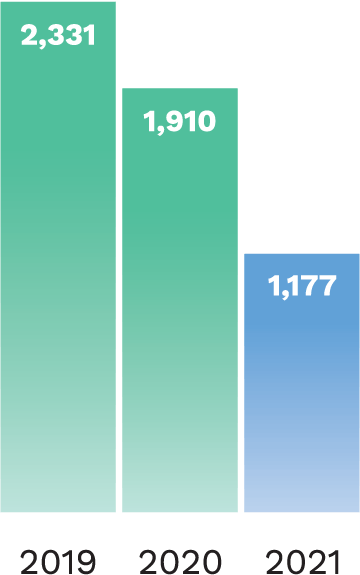

REVENUE (in € millions)

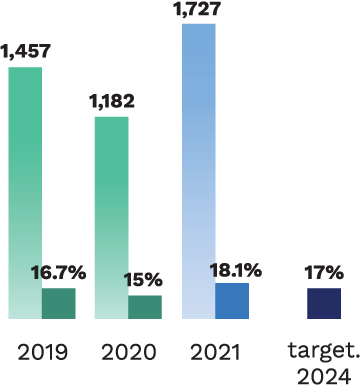

EBITDA (in € millions) AND EBITDA MARGIN (as a %)

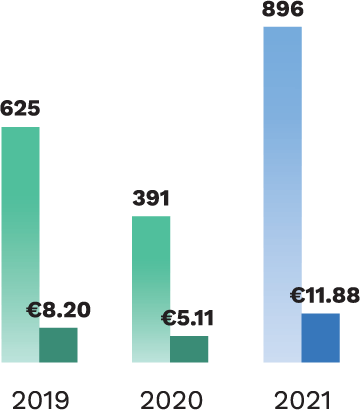

NET INCOME (in € millions) AND NET EARNINGS PER SHARE (in €)

NET DEBT INCLUDING HYBRID BONDS (in € millions)

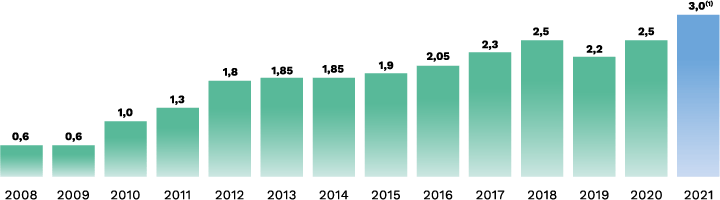

RISING DIVIDENDS SINCE 2008 (in €/share)